Operating in the financial services sector, complex regulatory changes will be a constant challenge for your organisation.

Our team can help to reduce their impact on your business model and keep you ahead of the competition. Our phased approach to meeting regulatory requirements allows you to manage change rather than being overwhelmed by it and to focus only on what is relevant.

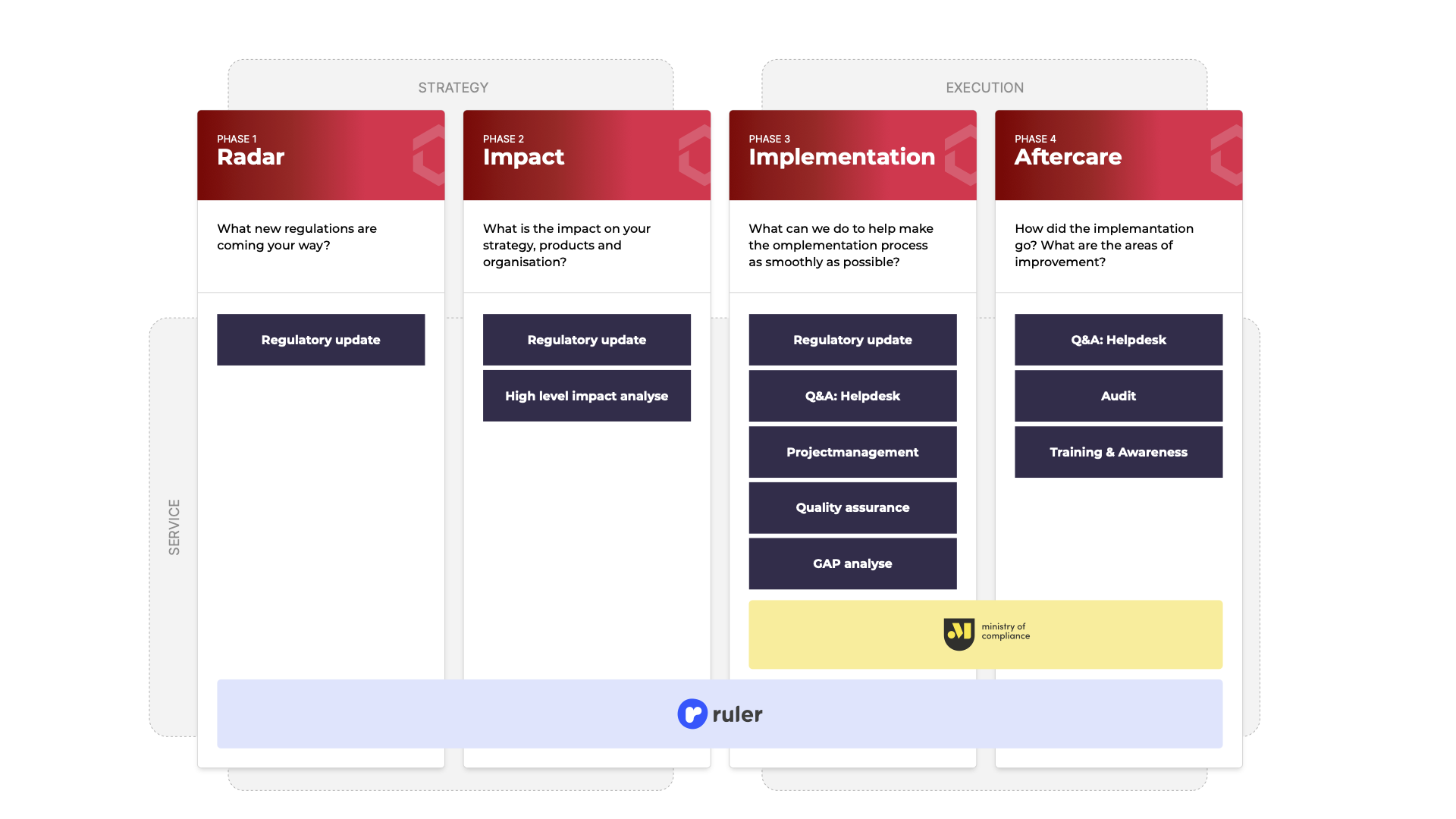

Phased approach

Often, we advise that a combination of input from your own specialists and our expert team is the best way to work through the process. A phased approach allows you to retain control by selecting the level of support that you require.

Whilst new regulations are under development, we work together to figure out their potential impact. We help you to understand how they may affect your business, products, and overall corporate strategy.

Once they have been finalised, we show you how to put them into action. Our regulatory change software tool, Ruler, is designed to support you during this phase.

This diagram shows how we support you at each stage of the regulatory process. You choose the service, and we tailor our offering to match your requirements.

How we can help

you

Regulatory

Watchtower

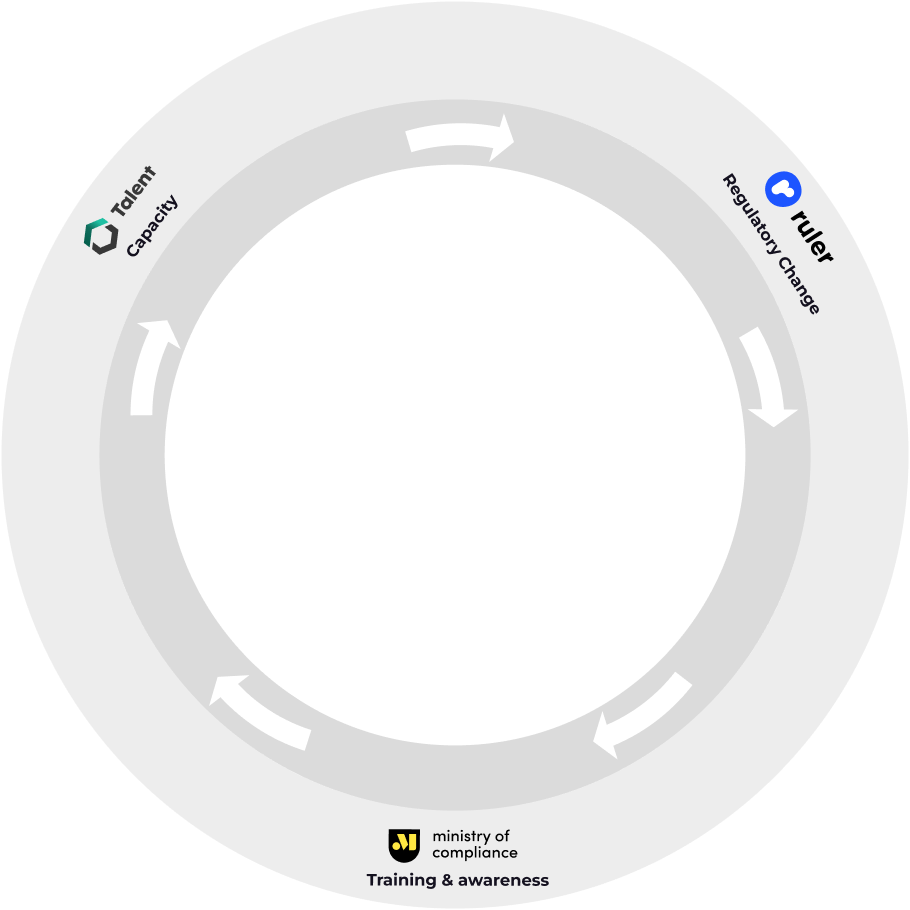

If you prefer, Projective Group can provide a regulatory watchtower service to guide you through the entire change process from start to finish. We can flag up new legislation when announced, provide an overview of the changes and, if they apply to your organisation, determine their impact.

This will help to make sure that you act quickly to adapt existing strategy and implement changes. We can also provide you with a transparent audit trail and decision-making record, helping you to show how you have implemented the legislation within your organisation.

Our team

Our regulatory change team is made up of experts in financial legislation and regulation. They are complemented by subject specialists who will take a deep dive into the new regulations to determine their impact on your business model, products, and organisation.

Regulatory Change

Tooling

When implementing a new directive or regulation, the various steps are often recorded in one large Excel spreadsheet - a confusing process and one that is prone to errors. We have developed a Regulatory Change module, Ruler, which automates and structures this process.