Compliance Policy

To maintain your organisation's good reputation, it is essential to adhere to the rules and regulations of the financial services sector. To achieve this, a strong compliance policy is essential. The policy should detail how your organisation complies with legal requirements and internal rules and the choices you make in this respect.

At ProjectiveGroup, our compliance specialists can either help you to assess whether your current policy meets the requirements or help you to create an entirely new policy.

What we do

Before we work together to draw up a compliance policy, we must first map out the legal framework of your organisation. This will identify the rules and regulations with which you must comply.

Once we have this information, we can highlight your compliance risks and development control measures to mitigate them. Finally, we translate this into a sustainable compliance policy, customised for your organisation.

Ruler compliance software

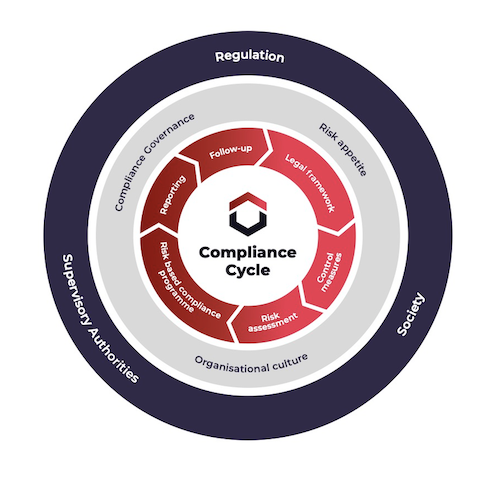

Compliance is an ongoing process. Formulating a compliance policy is just the beginning. Applying that policy in daily practice must be monitored and control measures implemented to show that you are complying with the latest standards. Our compliance software tool, Ruler, automates the process for you. Ruler helps you easily stay in control and comply with laws and regulations.